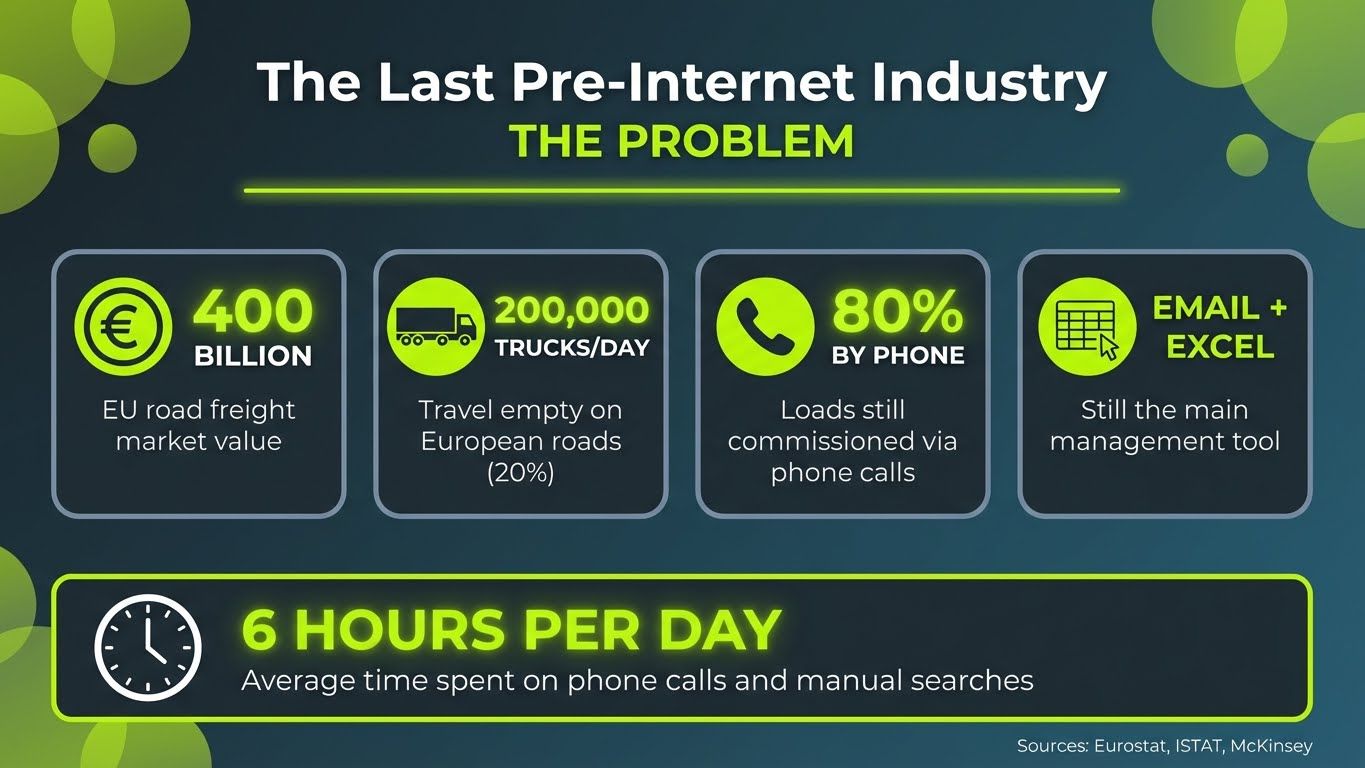

Road freight transport represents one of the fundamental pillars of the European economy, with turnover reaching €400 billion in the European Union alone in 2024 (excluding classic courier services such as postal and parcel delivery). Yet this strategic sector remains incredibly backward from a technological standpoint, characterised by severe inefficiencies, systemic waste, and deep information asymmetries that penalise all players in the supply chain.

It has been called "the last pre-Internet industry": while other industrial sectors embraced digital transformation decades ago, the freight transport world continues to operate with tools and processes that seem to belong to another era. Endless phone calls, Excel spreadsheets with thousands of rows, fragmented emails, and commercial relationships based on personal trust rather than verifiable data.

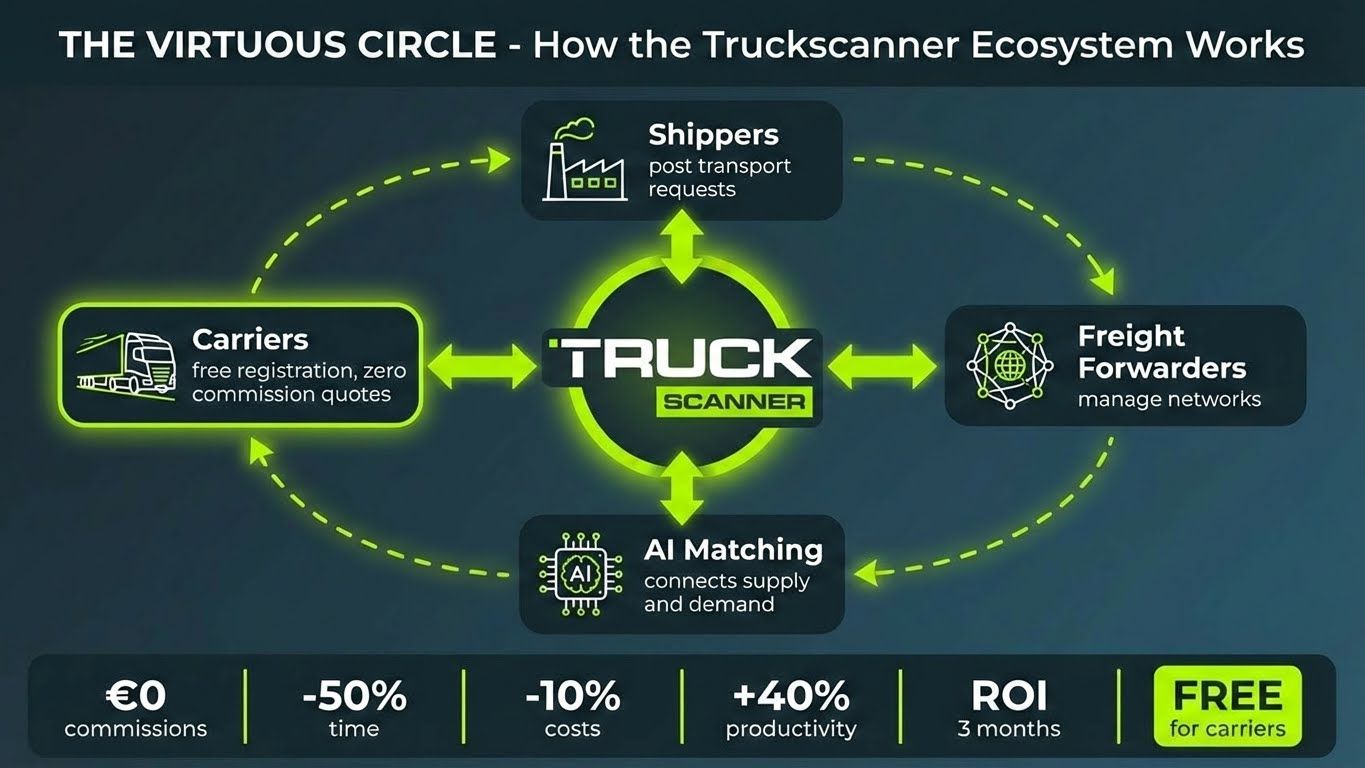

In this scenario, Truckscanner was born with a clear mission: to transform an ecosystem still anchored to phone calls, emails, and spreadsheets into an efficient, transparent, and connected digital environment. This is not simply another "load board" but an innovative digital ecosystem that combines business transport management (TMS) with an open marketplace in a single cloud platform.

The Problem: An Industry Twenty Years Behind

To fully understand the scope of the revolution that Truckscanner intends to bring, it is necessary to analyse in detail the structural inefficiencies afflicting the European freight transport sector.

Near-Zero Digitalisation

The most surprising data concerns how loads are still managed: 80% of transport commissions are still assigned exclusively by telephone, with an estimated 6 hours per day spent by logistics operators on phone calls to organise pickups, deliveries, negotiate rates, and manage unexpected situations. Most operators still use email and Excel spreadsheets for daily business process management: supplier databases in spreadsheets with formulas that break at the slightest touch, rate history scattered across hundreds of emails, transport documents printed, signed, scanned, and sent back.

This scenario creates what industry insiders call "the logistics office in permanent firefighting mode": phones ringing non-stop, shared spreadsheets nobody dares modify, formulas and macros that break if you look at them wrong. Operational chaos that translates into enormous hidden costs and systemic inefficiencies.

Empty Trucks on European Roads

One of the most visible consequences of this lack of digitalisation is the phenomenon of "empty runs": every day, 200,000 trucks or tractor units travel empty on European roads. This figure represents approximately 20% of total commercial vehicles in movement—a colossal waste in economic, environmental, and logistics system efficiency terms. These empty runs mean fuel burned unnecessarily, avoidable CO₂ emissions, vehicle wear without generating revenue, and driver working hours not valorised.

The main cause of this phenomenon is information fragmentation: shippers don't know which carriers are available on certain routes, carriers don't know which loads are available in the areas where they find themselves. The information exists but is scattered across thousands of isolated databases, non-communicating Excel spreadsheets, and non-scalable personal relationships.

The Problem with Traditional Load Boards: Expensive Subscriptions for Access Alone

For decades, traditional freight exchanges have represented the only attempt to digitalise the sector. Platforms like TIMOCOM, Trans.eu, Teleroute, and Wtransnet have built significant networks with tens of thousands of registered companies. However, these solutions present a fundamental structural problem: they require mandatory subscriptions of €150 or more per month just for network access.

This model creates a significant barrier to entry. Small hauliers, who often operate with razor-thin margins, are forced to pay hundreds of euros monthly simply to see available loads, without any guarantee of winning work. Shippers must subscribe just to post their transport requests. The result is a "closed" system where market access is reserved for those who can afford the subscription cost.

Furthermore, these platforms often offer only marketplace access, without integrated management tools. Companies must still manage orders, documents, negotiations, and invoicing on separate systems, multiplying operational complexity.

Market Fragmentation: Proprietary Networks and Internal Portals

Another problematic pattern that has emerged in recent years is the tendency of large logistics operators to develop autonomous and standalone logistics and transport networks. Logistics multinationals, large freight forwarders, and industrial groups have begun creating proprietary internal load boards and dedicated customer portals to become independent from market dynamics and traditional freight exchanges.

The motivations behind this trend are understandable: traditional freight exchanges are perceived as inefficient and, above all, do not allow managing one's own supplier network in a structured way. A company that has built trusted relationships with 50 carriers over the years has no tools to manage these relationships digitally on existing platforms. Historical carriers are mixed with thousands of strangers, negotiated commercial conditions cannot be managed, and collaboration history is not tracked.

However, this fragmentation creates new problems in turn: non-communicating systems, duplication of efforts, loss of overall market efficiency. Each large operator invests significant resources to build their own closed system, while the market as a whole remains inefficient.

Specific Pain Points for the Three Market Actors

For Shippers

Manufacturing and commercial companies that need to ship goods find themselves trapped in a paradoxical situation. On one hand, a carrier database limited to the same 10-20 historical hauliers, with no time to search for new ones nor tools to verify their reliability. On the other, no real market visibility beyond cold calls to companies found on Google.

Manufacturing and trading SMEs are particularly penalised: too small to interest large 3PL operators, too large to rely on parcel carriers. They find themselves in a "no-man's land" where access to competitive transport solutions requires resources they cannot afford.

Added to this is the difficulty of verifying carrier reliability: financial ratings, updated professional documents, valid insurance. Every new collaboration requires manual checks that take time away from value-added activities.

For Carriers and Owner-Operators

Hauliers face increasing pressure on already reduced margins. ISTAT data indicates that approximately 35% of kilometres travelled by Italian heavy goods vehicles are "empty"—return or repositioning trips that generate no revenue but involve all operational costs.

Small hauliers and owner-operators, who form the backbone of European transport, are particularly affected: expensive subscriptions to traditional load boards that can exceed €150 per month, payment uncertainty with new clients, no digital visibility to be found by potential shippers, the need to repeatedly send the same documents (insurance, authorisations, certificates) to every new commercial contact.

For Freight Forwarders

Freight forwarders operate as intermediaries between shippers and carriers, coordinating networks of dozens or hundreds of hauliers. Their daily challenge is managing this complexity with inadequate tools: network fragmented across different platforms, the need to continuously verify documentary compliance of their carriers, difficulty finding new capacity when regular suppliers are unavailable, TMS systems not integrated with load boards forcing double data entry.

The Solution: The Truckscanner Ecosystem

Truckscanner was born as a Freight Tech startup that natively integrates two souls in a single B2B SaaS with a "Freemium" model. This unique market combination simultaneously addresses all the identified pain points.

Transport Management Software (TMS)

The first soul of Truckscanner is a complete system for end-to-end management of business logistics processes. It eliminates phone calls, emails, and 10,000-row Excel spreadsheets, replacing them with a digital workspace where the entire team can collaborate in real-time.

Truckscanner's TMS offers: posting transport requests with immediate quote reception, centralised negotiation management with integrated chat, automatic generation of digital transport orders, always-accessible professional document archive for carriers, complete shipment traceability, dashboard for ISO 14083-certified budget and CO₂ analysis.

Thanks to Open Integration architecture, the platform connects with any company management system (ERP). Orders are automatically imported from the management system, published to the marketplace with one click, and transport data returns to the source system without duplication.

Transport Services Marketplace

The second soul is an open marketplace where transport supply and demand meet directly. But here lies the true innovation: no more being tied to the same 10-20 historical suppliers. With Truckscanner, companies access the entire market, compare prices, and negotiate directly.

And most importantly: the network is open and free for hauliers. Not a limited tier, not a trial: completely free forever. Carriers register at no cost, bid without commissions, and win jobs keeping 100% of what they earn.

The Freemium Model Innovation

While traditional freight exchanges require mandatory subscriptions of €150 or more per month just for network access, Truckscanner offers open freemium access with AI-powered matching. This structural difference completely changes market dynamics.

For carriers: free registration, free freight exchange access, free bidding, zero commissions on acquired orders. Premium plans exist for those wanting advanced features (priority visibility, AI matching, WhatsApp notifications, premium web showcase, margin analysis), but they are never mandatory.

For shippers: Basic plan from €49.90/month or Premium from €99.90/month that includes not just marketplace access but a complete TMS with all management features. Prices include unlimited company users, so the entire logistics team can collaborate without additional costs.

Company Network Management

One of Truckscanner's key innovations directly addresses the proprietary network problem: the platform allows inviting your trusted carriers to register for free, organising them by categories (vehicle type, operating areas, specialisations), and sending them targeted load opportunities with one click.

This creates a virtuous circle: the more forwarders bring their carriers to Truckscanner, the more the network grows for everyone. Shippers can digitalise existing relationships at no cost to their trusted hauliers while simultaneously accessing new verified carriers when additional capacity is needed.

End of fragmentation across dozens of load boards, Excel spreadsheets, and phone calls: your network organised, the market at your fingertips, everything in one digital space.

What Different Actors Get

For Shippers: A Complete TMS with Integrated Marketplace

Manufacturing and commercial companies find in Truckscanner a solution that can completely replace standalone TMS systems, which are often expensive and disconnected from the market. They can post transport requests and receive quotes from verified carriers, manage orders from entry to proof of delivery in a single workspace, build and manage private networks of trusted carriers, collaborate with the entire team in real-time, and analyse performance with budget and CO₂ dashboards.

Premium services add: AI Matches that automatically connect loads with compatible carriers, API integration with company management systems, digital yard and dock management with slot booking, verified carrier ratings (financial rating, years in business, documents), branded public logistics portal, dedicated support with direct introduction to new carriers.

For Carriers: Free Market Access

Hauliers and owner-operators access Truckscanner without ever paying anything. Registration is free, freight exchange access is free, bidding is free, and there are no commissions on acquired orders. This model is possible because network value grows with the number of registered carriers, making the platform more attractive to paying shippers.

With the free plan, carriers can: search for loads compatible with their vehicles and routes, receive automatic notifications for loads matching their operational profile, bid without limits, manage a digital archive of professional documents, and build a verified company profile visible to shippers.

For those wanting to maximise earnings, Premium services (completely optional) offer: priority visibility and AI matching, verified shipper information (financial rating, available budget), dock booking to eliminate queues and waiting, WhatsApp Business notifications for loads and quotes, Premium web showcase indexed on Google, and margin and CO₂ analysis dashboard.

For Freight Forwarders: Total Centralisation

Freight forwarders can finally stop juggling dozens of obsolete platforms. Truckscanner allows inviting their hauliers to register for free, organising them into groups, and sending targeted opportunities. As soon as a request is posted, they instantly receive 5 qualified matches with compatible carriers to close quickly.

The platform becomes the central point for: posting requests to their own network and to the open market, managing negotiations in a dedicated area with integrated chat, monitoring quotes and coordinating shipments, and integrating Truckscanner with their own TMS/ERP.

Premium Services: Added Value, Not Just Access

Unlike traditional freight exchanges that charge simply for network access, Truckscanner's Premium services offer real operational value:

For Shippers

AI Matches: posted loads receive automatic matches with compatible network carriers, who can be contacted directly to obtain quotes on-platform.

ERP Integration API: synchronisation with company management system to import orders automatically, zero duplications, marketplace publishing in one click.

Digital Yard and Dock Management: intelligent dock calendar that eliminates queues; carriers book their slot and the office organises everything with drag-and-drop.

Verified Carrier Ratings: financial rating, years in business, verified documents to choose reliable hauliers before assigning jobs, reducing risk.

Public Logistics Portal: a branded website without watermark where all requests are published; by sharing one link, suppliers see everything and bid.

Budget and CO₂ Dashboard: comparison between planned budget and actual spend per order, with ISO 14083-certified CO₂ reports ready for corporate ESG reporting.

For Carriers

Priority Visibility and AI Matches: contact with compatible shippers and direct receipt of requests from companies seeking transport, thanks to AI Matching services.

Verified Shipper Info: financial rating, available budget, and direct phone to know who you're dealing with, how much to quote, and close jobs before competitors.

Dock Booking: booking loading/unloading slots like booking a restaurant table; zero queues, zero waiting: arrive, work, and go. More loads per day, less stress.

WhatsApp Business Notifications: loads and quotes directly to WhatsApp with link to bid in 30 seconds, even while driving.

Premium Web Showcase: your own website without watermark, indexed on Google, to receive exclusive quote requests without commissions or competition.

Margin and CO₂ Analytics: dashboard that automatically compares prices and actual costs to discover which customers and routes really generate profit, with certified CO₂ data.

The Vision: Reference Platform for European Logistics

Truckscanner's objective is to become the reference platform for businesses in the logistics and transport market in Italy and Europe. This vision is built on four pillars:

Digital integration with all third-party business software for process automation and optimisation. Thanks to Open Integration architecture, Truckscanner connects with any management system.

A marketplace of cutting-edge and complete transport, warehouse, and recurring order services, where all market players can operate in a single digital space.

A unique offering of Premium AI services with added value for Routing, Planning, Visibility, and Booking, bringing intelligent automation to daily operations.

Integrated ancillary services including Insurance, Fintech, and Document Management, to address all operational needs of logistics operators.

Concrete Results

Truckscanner delivers measurable results:

€0 commissions on the marketplace: transactions occur directly between parties, without intermediation or retained percentages.

Up to 50% less time wasted on calls and bureaucracy, thanks to process digitalisation.

Up to 10% lower transport costs thanks to transparent competition and access to a broader market.

Up to 40% more productivity in the office, eliminating repetitive activities and tool fragmentation.

ROI in 3 months with Premium services, thanks to time savings and operational efficiency.

How to Get Started

Entering the Truckscanner ecosystem is simple and fast:

For shippers: the digitalisation journey starts in less than 3 minutes. After free company registration, you have immediate access to the management platform with all basic features, including direct market connection through the free freight exchange for all businesses. The Truckscanner team is available for personalised demos.

For carriers: registration takes just 2 minutes. Enter your company details (automatically verified through official registries), configure your fleet specifying vehicle types, capacities, and preferred routes, and start receiving instant notifications for loads matching your operational profile. No mandatory subscription to start, no commission on acquired orders.

A 7-day free trial is available with full access to all Premium features, without needing to enter payment methods.

Conclusion: The Future is Open

European freight transport is entering a new era. The sector's structural inefficiencies—near-zero digitalisation, market fragmentation, entry barriers from traditional freight exchanges, proliferation of isolated proprietary networks—are no longer sustainable in an economy that demands speed, transparency, and efficiency.

Truckscanner represents a concrete response to these challenges: a digital ecosystem that unites operational management and market access in a single platform, with a freemium model that eliminates entry barriers for hauliers and offers real value to shippers.

The digital freight revolution is no longer a future promise: it is a reality available today, ready to transform how businesses, carriers, and freight forwarders collaborate in the European market.

Sources: Eurostat, Istat, McKinsey, Truckscanner Investor Pitch 2025, Truckscanner SEO Keyword Research 2025-2026, Truckscanner Platform Documentation.

EN

EN

Deutsch

Deutsch  Polski

Polski  Espanol

Espanol  Română

Română  Nederlands

Nederlands  Français

Français  Italiano

Italiano